Daily Market Analysis and Forex News

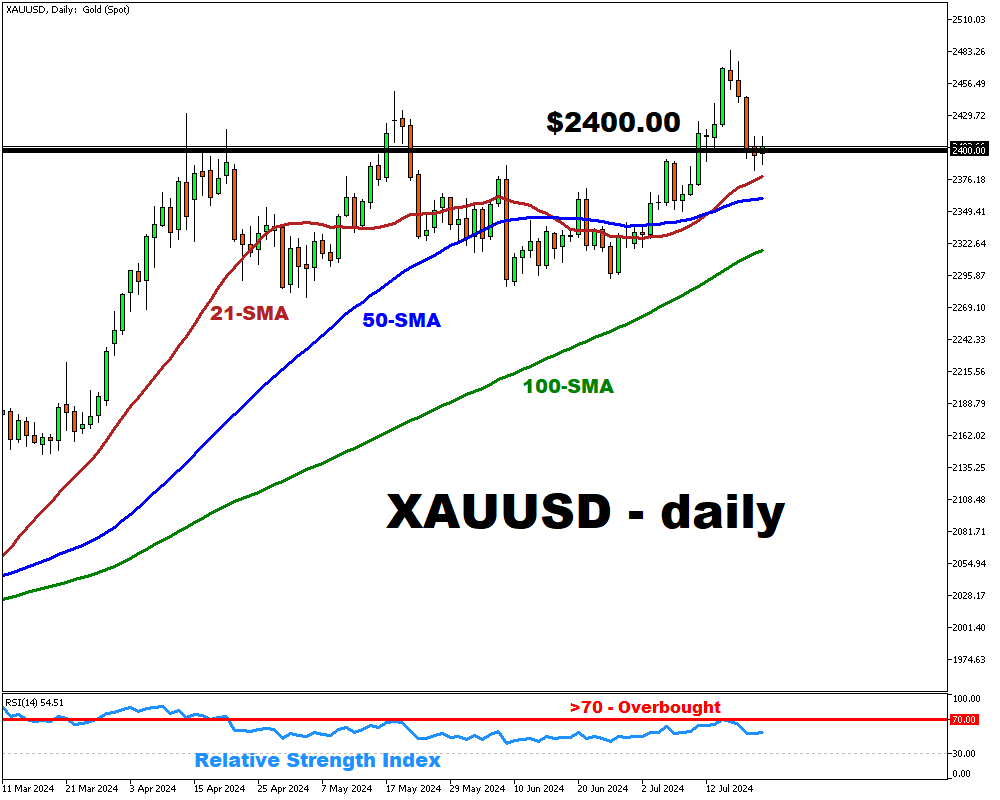

XAUUSD hovers around $2400 ahead of key US macro releases

- Gold prices retrace from last week's high levels

- XAUSUD is hovering around $2400 psychological level

- US dollar rebound causes recent pullback

- Market eyes potential Fed rate cuts support

- US political instability may boost safe-haven appeal

Gold prices have retraced from last week’s record high, now hovering around the psychological $2400 level.

The recent pullback was caused by the rebound in the US dollar.

The market’s focus is now on the potential Fed rate cuts.

In the short-term the prospects of the interest rate cuts in September will continue to provide support to the bullion.

The political instability in the US could also enhance the metal's appeal as a safe haven.

The gold’s trajectory will now largely depend on forthcoming US economic data.

Should the incoming GDP and PCE readings paint a “goldilocks” scenario for the US economy, which allows the Fed to move interest rates lower, that should help keep gold above $2400.

Conversely, if economic growth and inflationary pressures are stronger than expected, gold could retreat to the mid-$2300 range.

Looking ahead, if the market believes the Fed will manage a third rate cut before the end of 2024, gold could revisit its recent highs.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.