Daily Market Analysis and Forex News

This week: US500 earnings highlights for key stocks in August

- 1900 US stocks reporting earnings

- SMCI Earnings: Tues, Aug 6, forecasted move 11.4%

- Disney earnings: Wed, Aug 7, forecasted move 6.5%

- Eli Lilly earnings: Thurs, Aug 8, forecast move 6.4%

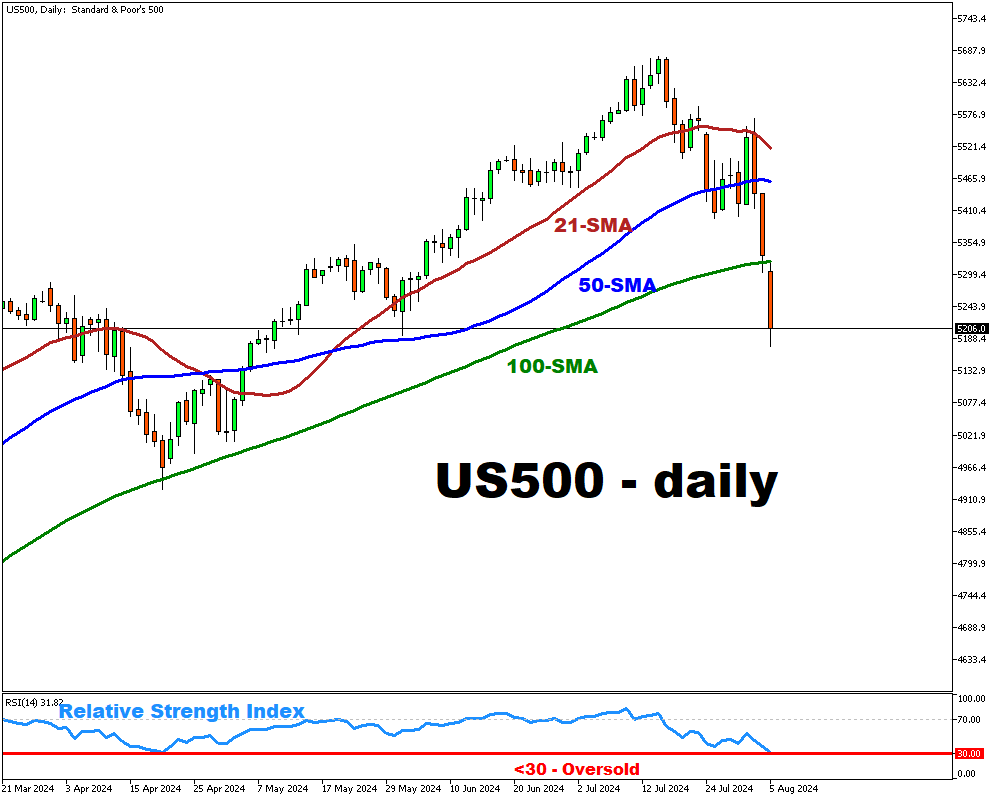

Amidst the declines across global equity markets, the US earnings season still rolls on.

This first full week of August presents potential investing and trading opportunities galore across the 1900 different US stocks that are reporting their respective quarterly earnings.

In this lookahead, we highlight a range of stocks: the household name - Walt Disney, pharma giant - Eli Lilly, as well as the best-performing stock on the S&P 500 so far this year – Super Micro Computers.

While coming from diverse industries, the common theme is that they’re all primed to react to their respective earnings. You’ll find each stock’s forecasted one-day, post-earnings % move below.

Events Watchlist:

-

Tuesday, August 6th: Super Micro Computer earnings (after US markets close)

Super Micro Computer’s (SMCI) shares have risen about 130% so far this year, beating Nvidia along the way, though the former’s market cap of US$ 39 billion is dwarfed by the latter’s valuation of US$2.6 trillion.

Nvidia’s power-hungry GPUs are liquid-cooled by SMCI’s server racks. Markets will hope that this relatively smaller AI-player can beat last week’s swathe of disappointing Big Tech earnings.

SMCI’s shares are forecasted to move by 11.4% up/down when markets open for trading on Wednesday.

-

Wednesday, August 7th: Disney earnings (before US markets open)

Although Disney’s earnings (till end-June 2024) will not include numbers from “Deadpool & Wolverine”, its film studio is set to report its first quarterly profit since 2022.

Amid a company-wide cost-cutting drive, traders and investors will also monitor Disney parks’ profitability amid growing recession fears, as well as the aim to make Disney+ profitable by end-2024.

This stock could move 6.5% up/down when markets open on Wednesday.

-

Thursday, August 8th: Eli Lilly earnings (before US markets open)

This stock has risen over 40% so far this year and now has a market cap close to US$800 billion, thanks to the excitement surrounding its weight-loss drug, Zepbound. With much already expected of this pharma giant, its sales growth and operating margins will come under scrutiny, whether it beats or falls short of forecasts.

Eli Lilly’s shares are forecasted to move by 6.4% up/down when markets open for trading on Thursday.

Here’s a comprehensive list of other key economic data and events due next week:

Monday, August 5

- CN50 index: China July PMIs

- JP225 index: BoJ meeting minutes

- SG20 index: Singapore June retail sales

- EU50 index: Eurozone June PPI

- USD index: speech by San Francisco Fed President Mary Daly

Tuesday, August 6

- AUD: RBA rate decision

- EUR: Eurozone June retail sales; Germany June factory orders

- Earnings: Super Micro Computers, Uber, Airbnb

Wednesday, August 7

- NZD: New Zealand 2Q unemployment rate

- CNH: China July external trade

- GER40 index: Germany June external trade

- Earnings: Disney

- MXN: Mexico July CPI, rate decision

Thursday, August 8

- TWN index: Taiwan

- GER40 index: Germany June industrial production

- US2000 index: US weekly initial jobless claims; speech by Richmond Fed President Thomas Barkin

- Earnings: Eli Lilly

Friday, August 9

- CHINAH index: China July CPI and PPI; Alibaba earnings

- CAD: Canada July unemployment

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.