Daily Market Analysis and Forex News

This Week: Opportunities in FX, US stocks & indices?

- US dollar index sees biggest drop in 2024

- Gold and US30 hit new record highs in August

- BoC expected to cut rates to 4.25% on Sept 4th

- Broadcom earnings report due on Sept 5th

- US nonfarm payrolls data to impact markets on Sept 6th

August was a wild ride for financial markets: the US dollar index posted its biggest monthly decline so far in 2024, while gold and the US30 stock index registered new record highs respectively.

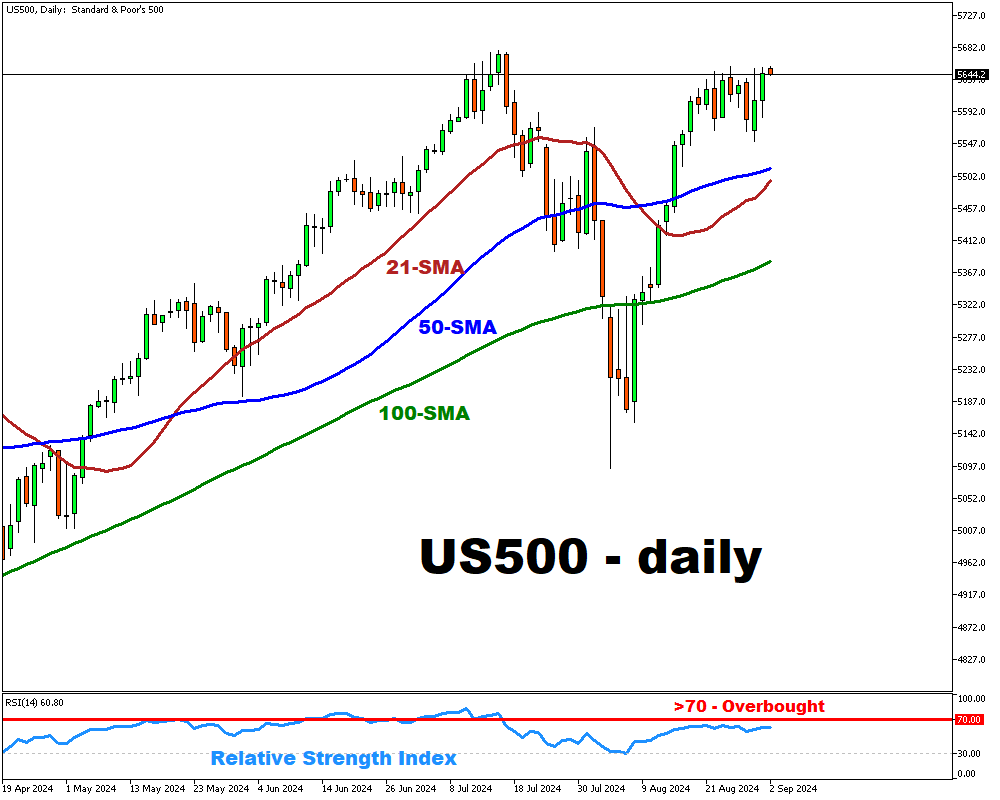

The S&P 500 (US500) fell as much as 8% before a stunning comeback restored it close to its all-time peak.

This new month of September promises its own thrills. In this week’s preview, we showcase potential opportunities across FX (USDCAD), US stocks (Broadcom), and stock indexes (US500).

We’ll soon find out if the market volatility, and trading opportunities, mirrors those from the month prior.

Events Watchlist:

-

Wednesday, September 4th: Bank of Canada (BoC) rate decision

The BoC is widely expected to deliver its third straight 25-basis point rate cut, lowering its Overnight Lending Rate to 4.25%.

More dovish language out of Governor Tiff Macklem this week could leave USDCAD closer to the upper end of its 1.333 – 1.360 forecasted range this week, at least until Friday’s US nonfarm payrolls report.

-

Thursday, September 5th: Broadcom earnings (after US markets close)

With a market cap of about US$ 730 billion, Broadcom is among the 10 biggest stocks on the S&P 500 index.

This semiconductor company is due to unveil its latest quarterly financials after US markets close Thursday.

Once markets reopen Friday, its share price is forecasted to move 6.8% up or down, depending on what the company conveys about last quarter’s earnings and its expectations for future profits, especially for its AI business.

-

Friday, September 6th: US August nonfarm payrolls (NFP)

Recall that the July US unemployment rate spiked up to 4.3% - its highest since 2021.

That sparked the 3rd biggest one-day decline for the S&P 500 (US500) year-to-date, as it fell 1.8% on August 2nd (followed by a 3% drop the following Monday, August 5th - its largest one-day drop so far in 2024.

Much focus will be on that jobless rate once more. A still-elevated jobless rate of 4.3% or higher in August could spark another selloff and drag the US500 closer to the 5500 level.

If the unemployment rate ticks back down to 4.2% as forecasted, that could help the US500 post a new record high!

Here’s a comprehensive list of other key economic data and events due this week:

Monday, September 2

- CNH: China manufacturing PMI

- TWN index: Taiwan manufacturing PMI

- AUD: Australia inflation

- US markets closed

Tuesday, September 3

- CHF: Switzerland CPI; 2Q GDP

- EU50 index: Eurozone retail sales

- RUS2000 index: US ISM manufacturing

Wednesday, September 4

- AUD: Australia 2Q GDP; composite and services PMIs (final)

- CN50 index: China services and composite PMIs

- EU50 index: Eurozone PPI; services and composite PMIs (final)

- US400 index: Fed Beige Book; US factory orders

- CAD: Bank of Canada rate decision

Thursday, September 5

- AUD: Australia trade balance

- SG20 index: Singapore retail sales

- TWN index: Taiwan CPI and PPI

- EUR: Eurozone retail sales; Germany factory orders, construction PMI

- USD index: US weekly initial jobless claims; ADP employment

- Broadcom earnings

Friday, September 6

- EUR: Eurozone 2Q GDP and employment (final); Germany July industrial production and trade balance

- CAD: Canada unemployment, composite and services PMIs

- US500 index: US nonfarm payrolls

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.