Daily Market Analysis and Forex News

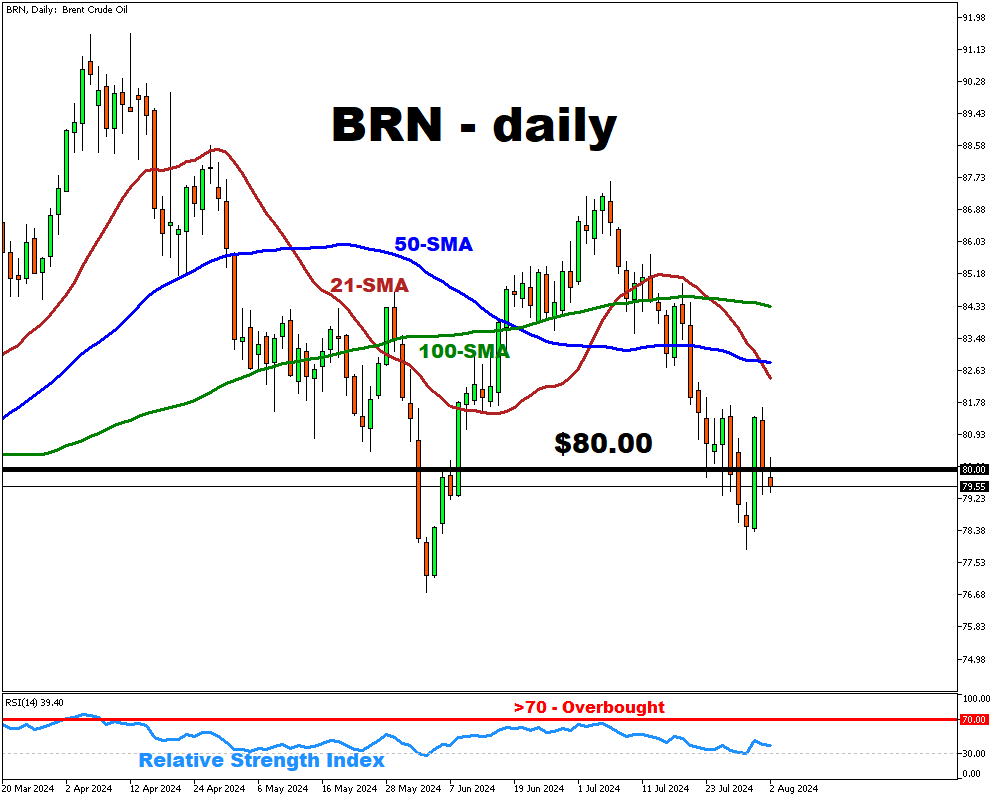

Brent may be set for longest losing streak since December

- Brent crude nears $80/bbl, facing potential decline

- BRN verge of longest losing streak this year

- Demand issues overshadow supply risks

- Concerns about China's global demand impact

- OPEC+ output increase may worsen oversupply

Brent crude is nearing the $80 per barrel mark and is on the brink of experiencing its longest losing streak of the year, with four consecutive weekly declines.

The oil market is grappling with demand-related issues that are counterbalancing some of the supply-side risks associated with rising geopolitical tensions.

Besides concerns about China's impact on global demand, there are also uncertainties about whether the Federal Reserve might be slow to implement rate cuts.

These cuts could support demand, especially as the US economy shows early signs of slowing down.

The risk of oversupply could increase if OPEC+ follows through with planned output increases in the fourth quarter, potentially exacerbating the situation in a weakening global economy and giving more leverage to oil bears in the meantime.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.