- Eurozone CPI may steer ECB rate cut bets

- Powell speech eyed for dollar policy clues

- US jobs data may sway Fed’s rate outlook

- US Tax bill could shake market sentiment

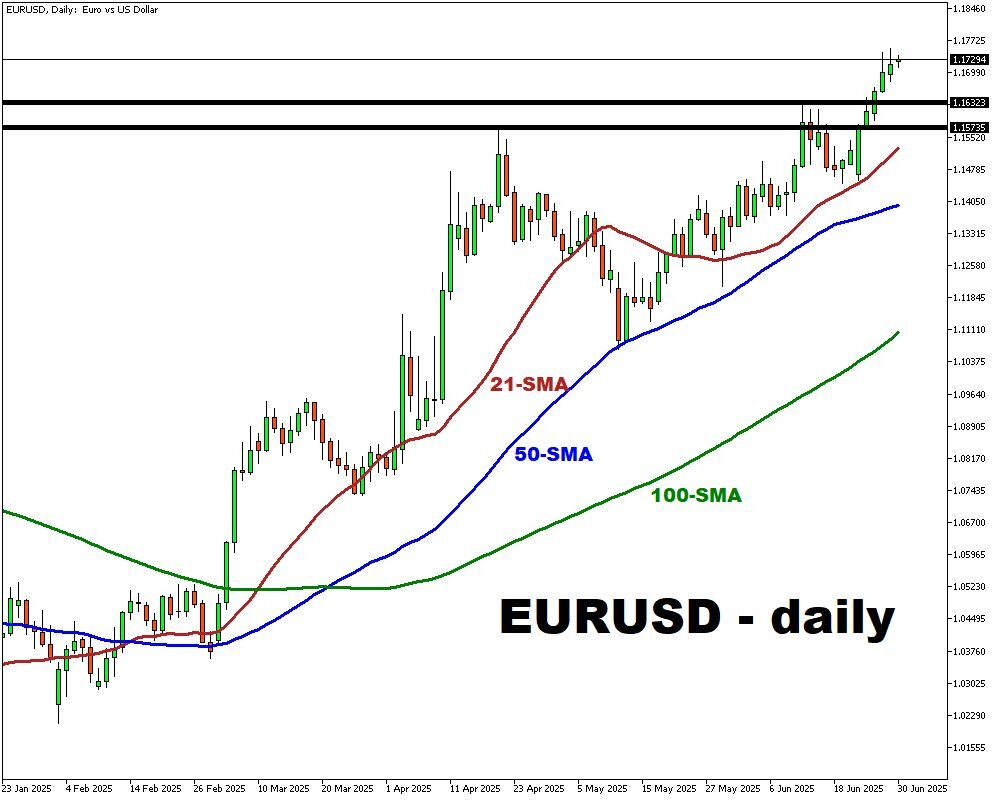

Economic uncertainty, evolving fiscal policy, and future interest rate expectations are steering EURUSD. Traders are on high alert as upcoming economic data, Fed Chair commentary, and the upcoming Senate vote on the U.S. tax bill could shift the current narrative and trigger price swings.

EURUSD remains responsive to economic developments, with inflation trends, fiscal signals, and growth indicators driving its direction. Market volatility may persist as participants assess key macroeconomic signals.

Events Watchlist:

Tuesday, July 1st: Eurozone Inflation

The Eurozone CPI will be an important print for the euro. Softer inflation may increase speculation of another ECB cut, potentially pushing EURUSD down toward support near 1.15735-1.16323. A stronger-than-expected print could provide a lift to the Euro.

Tuesday, July 1st: Fed Chair Jerome Powell Speech

Markets will be watching closely for any policy clues. A hawkish tone could strengthen the dollar and send EURUSD lower, while dovish comments may give the euro room to climb. Traders will be especially sensitive to any remarks on labour market or inflation.

Thursday, July 3rd: US Non-Farm Payrolls

A strong jobs report could reinforce the Fed’s wait-and-see posture, adding pressure on EURUSD. Weak numbers might fuel US rate cut expectations, potentially lifting the euro in response. Wage growth data will also be in focus as a key signal for inflation momentum.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, June 30

- CNY: China June NBS Manufacturing PMI

- EUR: Germany June Inflation Rate; May Retail Sales, ECB President Speech

- NAS100: Atlanta Fed President Bostic Speech, Chicago Fed president Golsbee Speech

- JPY: Japan Q2 2025 Tankan Large Manufacturers Index

- Tentative: Senate vote on U.S. Tax Bill (“Big Beautiful Bill”)

Tuesday, July 1

- CNY: China June Caixin Manufacturing PMI

- JPY: Japan June Consumer Confidence, BoJ Governor Speech

- CHF: Swiss May Retail Sales

- SPN35: Spain June HCOB Manufacturing PMI

- GER40: Germany June Unemployment Change

- EUR: Eurozone June Inflation Rate

- USD: US Fed Chair Powell Speech; June ISM Manufacturing PMI; May JOLTs Job Openings

- WTI: w/e Jun 27 API Crude Oil Stock Change

Wednesday, July 2

- AU200: Australia May Retail Sales

- SPN35: Spain June Unemployment Change

- USD: US June ADP Employment Change

- CAD: Canada June S&P Global Manufacturing PMI

- WTI: w/e Jun 27 EIA Crude Oil Stocks Change

Thursday, July 3

- AUD: Australia May Balance of Trade

- CNY: China June Caixin Services PMI

- CHF: Swiss June Inflation Rate

- CAD: Canada May Balance of Trade

- US500: US June Non-Farm Payrolls, Unemployment Rate, ISM Services PMI; w/e Jun 28 Initial Jobless Claims; Fed Bostic Speech

Friday, July 4

- CHF: Swiss June Unemployment Rate

- GER40: Germany May Factory Orders

- FRA40: France May Industrial Production

- MXN: Mexico June Consumer Confidence

- SPN35: Spain May Consumer Confidence